America’s Housing Numbers Don’t Lie...

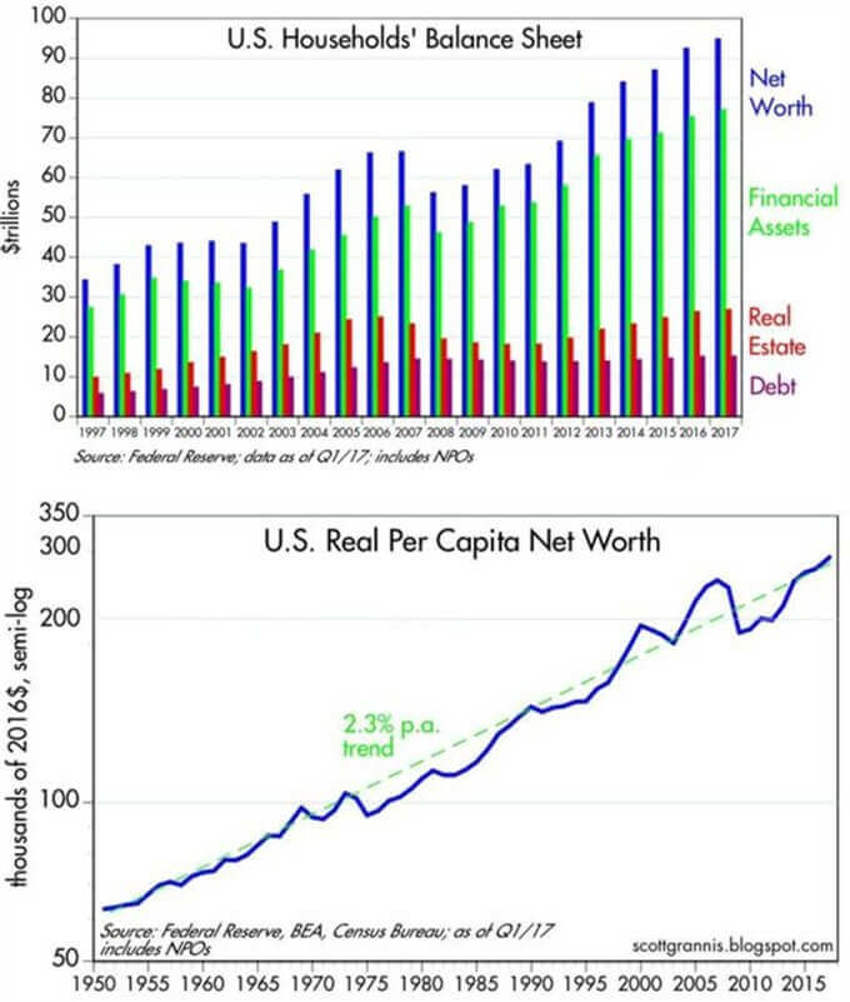

US Household net worth has set yet another record.

Have a look at the two charts below from Scott Grannis of the Calafia Beach Pundit blog.

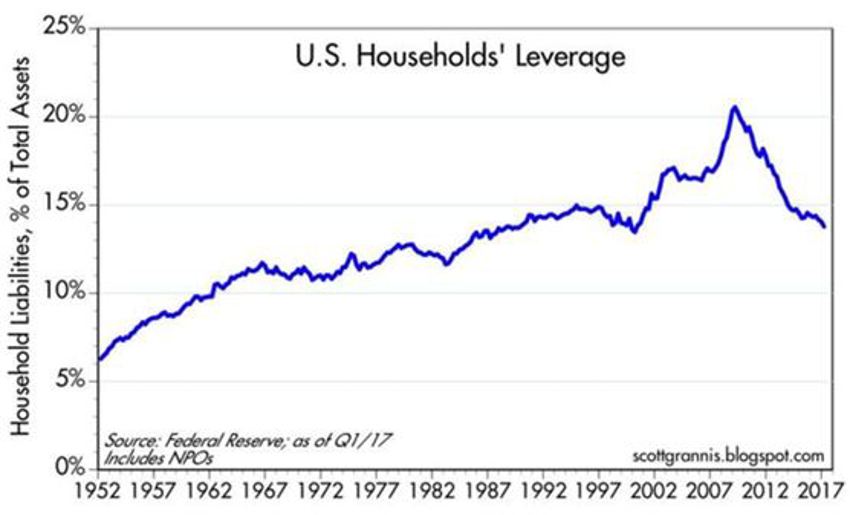

What’s interesting to note, and conveniently overlooked by the mainstream media, is that America is setting records in net worth on a per capita basis even as leverage falls:

Lower Leverage

The chart below shows we are back to leverage levels on assets not seen since the mid-1980s:

Folks, this is a very long way away from the tragic financial terror that struck everyone during the financial crisis of 2008-2009.

We can slice it anyway we like, or remain afraid for as long as we need to, but the improvement is clear.

Let's Get Specific

These are the latest data points from the US Federal Reserve:

- As of March 31, 2017, the net worth of U.S. households (including that of Non-Profit Organizations, which exist for the benefit of all) reached a new record of $94.84 trillion.

- In the last year alone, that’s up $7.3 trillion - with an even larger increase of $27.2 trillion since the pre-2008 collapse peak.

- During that same period of time, household liabilities have increased just $510 billion.

Scott Grannis highlights this in more detail as well (the words in bold are my addition):

"The value of real estate holdings is up about $1.9 trillion (+7.6%) from that of the "bubble" high of 2006, and financial asset holdings have soared by almost $24 trillion (+45%) since pre-crash levels, thanks to significant gains in savings deposits, bonds, and equities. The gains in wealth are not just due to a raging stock market, since the market cap of all traded U.S. equities has risen by only $8.4 trillion since its pre-2008 high, according to Bloomberg."