Follow the Trend Lines, Not the Headlines

The second read on US GDP is that it went up to 3.3%, and inflation went down.

That happened while many other important categories set records.

And yet…?

You could have heard the crickets over any noise the media made about this positive development.

In fact, Matt Lauer made more headlines.

It’s pathetic:

The two snapshots above show increasing records set in major US corporate investments both on residential investment and industrial equipment, as more manufacturing activity returns to America from overseas.

That type of trend tends to be very positive over the long-term, particularly when accompanied by record-setting performances across R&D channels.

Yet, the deaf ears reign.

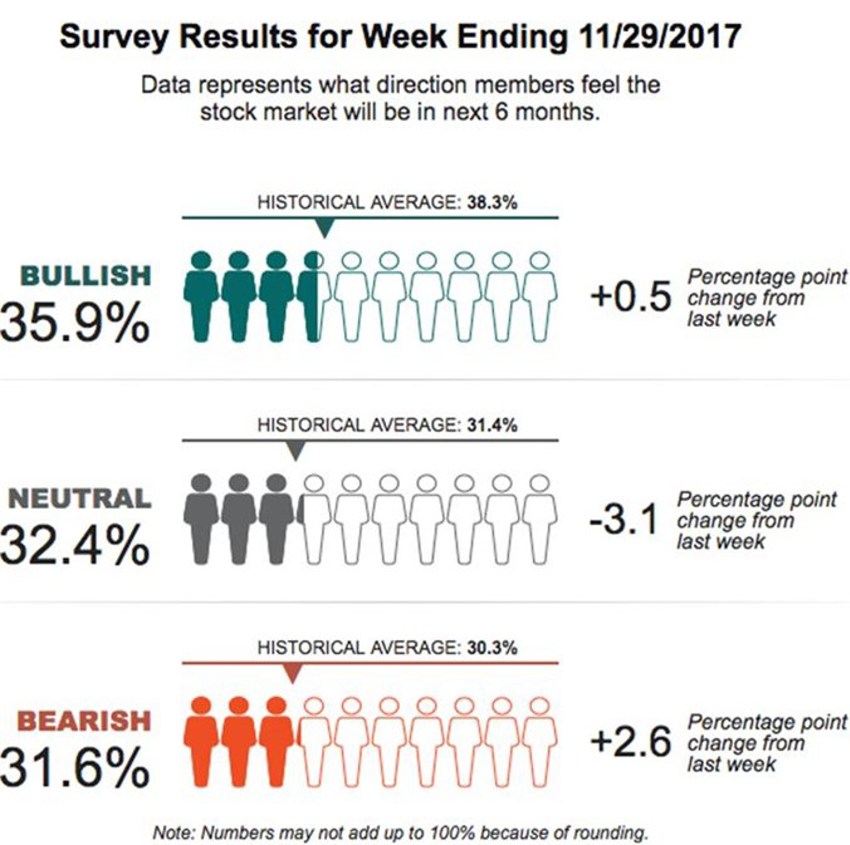

Check out the latest from the sentiment camp:

Mystifying Right?

How can we worry about the crowd falling in love with stocks on the way to euphoria is they haven’t even left the Neutral camp?

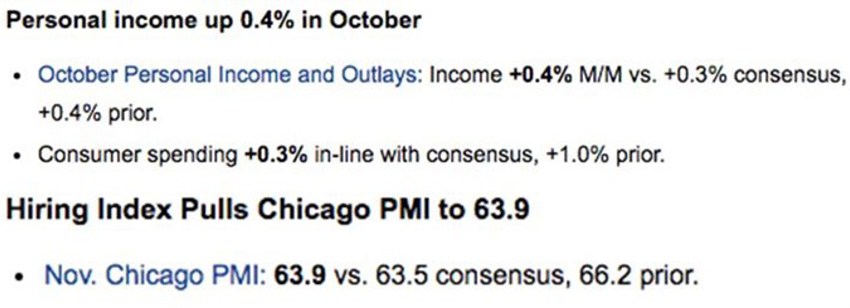

We know the problem isn’t personal income because that’s setting records as well. Retail sales are also solid and savings on deposit are closing in on $11 Trillion.

Collectively, we have never had more people employed, more job openings available and / or more wages being earned.

Heck, it was hiring that pulled the latest Chicago PMI data to higher levels:

Yet, with all that said folks are still lining up to buy bonds.

And they’re doing so at 2.39% for the next decade.

Really?!

Now, I know I’m always saying that we should be praying for a correction.

And because of that I get calls and emails from people who think I’m suggesting a correction is coming.

But that’s not true.

I really am just praying for a correction.

And yes, of course a correction is coming at some point in the future, but my crystal ball is still in the shop.

Until it’s fixed we’ll just need to operate in the same environment that we have done since the beginning of investing; where not a soul on earth knows when the next correction is coming.

The reason I say “pray for a correction” is so that we can; a) get some good deals and, b) keep the fear deeply entrenched for the next 15,000 Dow Jones points up.

In Summary

You know, sometimes I kind of wish there was some horrible news to share with you.

It would easier.

But that wouldn’t help build your wealth, mend your health or save you from anything.

And keep in mind that if investing were easy they’d have called it “fun” instead, and not the life-journey of building towards your financial goals.

So buckle up because it’s probably going to be a wild ride.

Just remember not to get up and leave it or someone else will be waiting to take your seat.

Long-term thinking always wins out over short-term trading. Worrying about the next setback sells lots of ads but makes almost no money for you. History proves it.