In 2016, Patience Worked & Emotions Did Not

Sure, it had ugly spots, but I for one would argue that 2016 wasn't that bad as we round the final turn to the home stretch.

The bottom line: Patience worked and emotions did not.

Stocks were uneasy, interest rates spun upward as the bond boys awoke, and Brexit issues came and quickly went.

The worst start in 80 years was followed up quickly by the "best intra-quarter recovery" in 83 years.

And now here we are staring into the haze ahead; the holiday retail statistics about “What everyone did and didn’t buy,” the tricky percentages, the media sound bites…

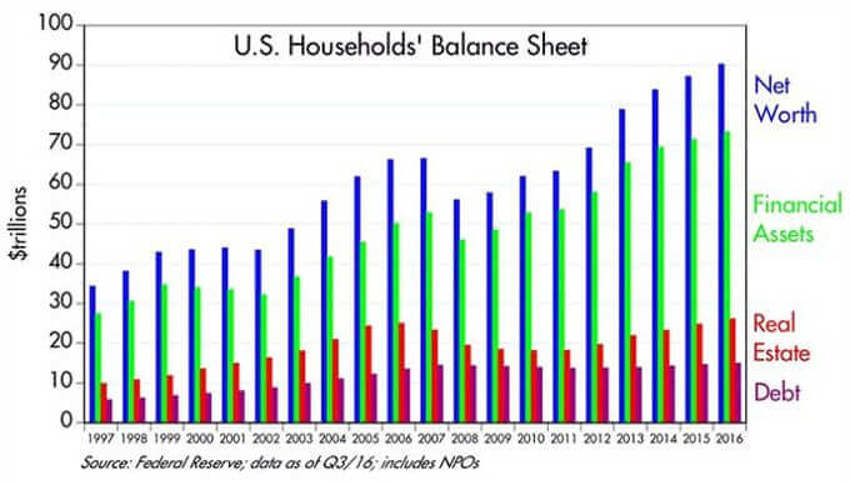

Don't be fooled. It's busy out there. And as we noted a couple weeks ago; America has never been richer:

Peering Over The Edge

So as we plan for the New Year, we simply need to be aware of the idea that we could be seeing the market get a little bit ahead of reality.

Now, I’m not saying that because I’m concerned about the markets.

I say it because I am now concerned about people's emotions. We have all seen enough to know they are only skin deep.

And just as we’re told how wonderful people are feeling again, we all know a few weeks of ugly trading and a drop back below 19,000, for example, would show you just how little market confidence there is in the investor herd, and how quickly they are to sell stocks.

Logic Not Emotion

It is perfectly logical to assume that the first one hundred days in office for Mr Trump will be both exciting and a steep learning curve.

In other words; it may not all go smoothly, even if it ends exactly where we hope it does by summer.

So let's stay focused on the long-run, well-seeded and underlying support in our economic system.

Parts of our economy are very strong as the generational shifts underway continue to work their way into the process.

Likewise, there are other parts of the economy that are feeling the stress of change.

Both are lined up to end very nicely as the dust clears, but only for those who can remain patient and who do not react to every bump in the night.

And we can all be assured that the first year for President Trump will have some bumps in the night.