In The Long Run…

Easily forgotten is the barn-burner earnings season of Q4, 2017, as the Q1, 2018 session starts in just a few more weeks.

And we should now expect to see the trickling effects of US tax changes, as many companies currently without a handle on the massive benefits from expanded investment dollars adjust to that new fiscal world.

The latest this weekend from Thomson Reuters is just an inkling of what’s to come:

• Forward 4-quarter estimate: $158.32 vs. last week's $158.23.

• P.E. ratio: 17.4x

• PEG ratio: 0.83x

• S&P 500 earnings yield: 5.75% vs. last week's 5.69%.

• Year-over-year growth rate of forward estimate: +20.8% (note this: these numbers mark the 17th consecutive week of sequential increases in the year-over-year growth rate).

Now step back and consider how over the long-term the S&P 500 regularly corrects, on average, 15% a year, keeping in mind that the fundamental S&P 500 earnings trends are still positive.

In fact they’re very positive.

The acceleration in expected 2018 EPS growth is unmistakable. And it's far more powerful than most of the short-term garbage in the news that almost begs you to react poorly.

Finally, for perspective:

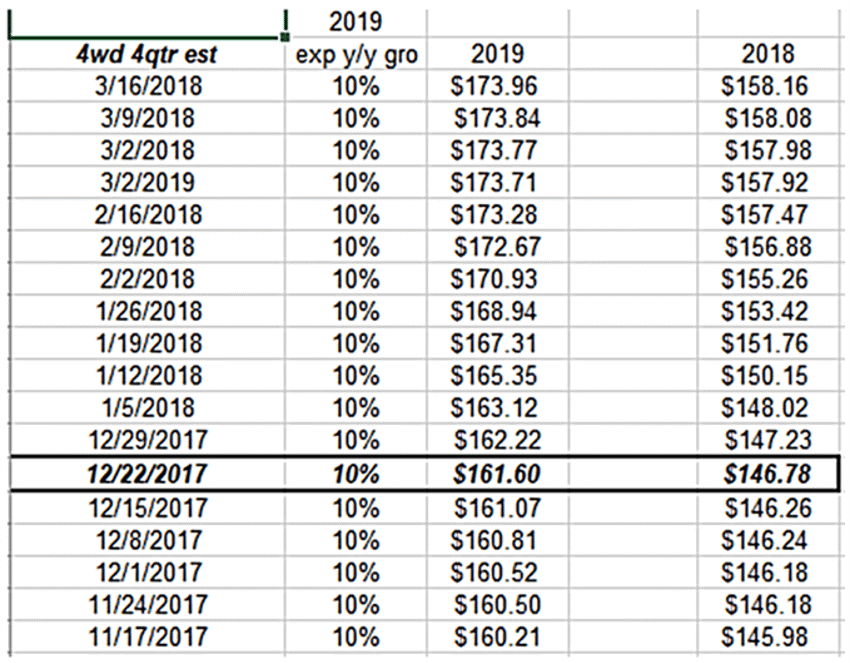

The chart above is just to help you see the stages of growth as the effect of the US tax law rolls through reporting processes.

The highlighted box is the date the tax law changes were signed. The net result long-term is that even as markets got flooded with red ink to begin this week, it will be valuable to mentally note that by about July/August of this year, experts will be "pricing" markets on 2019 earnings multiples.

Today, that P/E stands at 15.60 times that forthcoming 2019 number from just this past weekend.

With this week's red ink that number for 2018 stands at about 17.16 P/E…...while those ugly old bonds are still over 35 times earnings.

A Final Thought

It is the spirit of innovation and the demographic powers in place that are driving the Barbell Economy as it hands over the economic reins from the Baby Boomer generation to what is now the world’s largest age cohort: The Millennials of Generation Y.

And it will be a patient and disciplined view of the larger forces at work here that help define a more productive financial, economic and investment philosophy for the future, no matter who resigns from or resides in the White House.

Over wide spans of time, It’s people who make markets.