goInvestors: It’s Better Out There Than They’re Telling You

US market data is generally positive and jobs are solid.

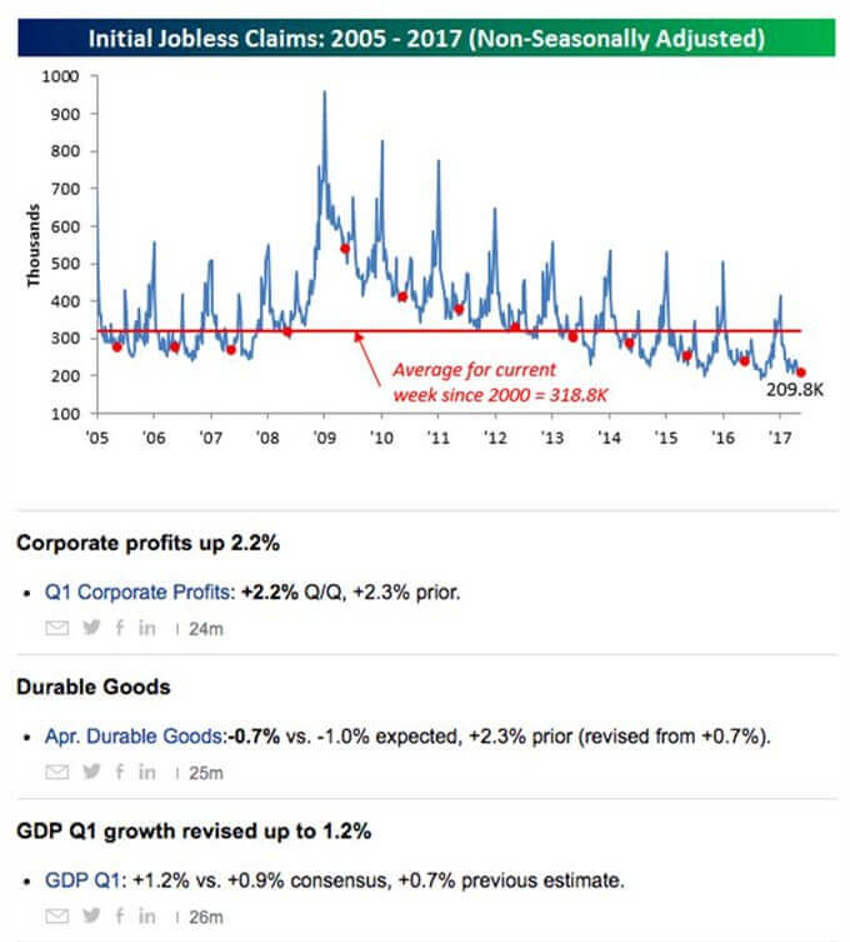

In fact, jobless claims are severely depressed. And the flip side of that coin is even better - job openings are at record highs.

Hence, all those kids you keep hearing about leaving college with a lot of debt should have plenty of offers to go to work - and begin shedding that debt quickly.

It's called planting seeds for the future (the media will call it Armageddon).

On a non-seasonally adjusted basis, US jobless claims actually rose slightly from 207K up to 209.8K.

But we can overlook that tiny increase because this week’s level was still more than 100K below the average for the current week of the year dating all the way back to 1973!

Note also that corporate profits are up nicely in the latest data updates above.

Durable goods look negative at first glance, but they’re not. Check the revision to last month's reading - they tripled the growth rate!

It's Global

The good news is that US-based global companies are now able to capture benefits from what is a slow but steady recovery process on a global scale.

And as is usually the case, the US is leading it. That said, the rest of the world is also coming around.

Not every spot is perfect, but green shoots are appearing on the horizon nicely.

Let's get a few data points from Dr Ed Yardeni and his team:

- The rapidly improving and upbeat outlook for 2018 earnings isn’t happening only in the US. A quick review shows that the consensus expected earnings estimates are actually rising for both 2017 and 2018 overseas as well. As a result, forward earnings (in local currency) of the All Country World ex-US MSCI rose in mid-May to the highest level since November 2008!

- To help tide us over from fears about a summer swoon (a headline that should begin to roll out soon on all financial media channels), the latest batch of global economic indicators shows plenty of slow but steady growth, with some even-better-than-expected numbers out of Europe. You remember Europe right? It was the Armageddon topic for most of 2015:

- The Eurozone C-PMI (56.8), M-PMI (57.0), and NM-PMI (56.2) all were all strong in May.

- In the US, the C-PMI (53.9) recovered some ground that was lost at the start of the year, led by the NM-PMI (54.0), while the M-PMI (52.5) fell for the fourth month in a row.

- Japan’s M-PMI (52.0) edged down in May, but has exceeded 50.0 for the past nine months.

- On the GDP front - note the data above as we got the second review of Q1 - and it popped up a bit as expected. The latest y/y growth rates for Q1 real GDP for the UK (2.1%), Eurozone (2.0), US (1.9), and Japan (1.6) suggest that the global economy is enjoying global synchronized growth that is nicely sandwiched between a boom and a bust.

Heck, even Germany is getting a boost from these past months of a weak Euro. May’s German Ifo Business Confidence survey leapt to the highest reading in the history of the survey going back to 1991.

It was led by the current situation index, which also rose to the highest on record!

The Bottom Line?

This is a long train, and success demands patience and discipline in this game.

Don't expect every week, month or quarter to be perfect. It won't be. And that’s a good thing.

Summer is here, so get ready to hunker down and expect some boredom to begin edging into the picture.

Don't forget the back-drop as chatter about summer swoons will also enter the picture soon.

And finally, think demographics not economics.

Just off the bow is the USS Summer Haze and often, hidden in the noise, opportunity appears.

We’ll be looking out for it.