Overvalued or Underappreciated?

Years past teach have taught us to prep ourselves for a slower environment as this week rolls in.

In fact, the pre-Christmas period can lead to a bit more chop as volume diminishes and people pack up or pack in for the holidays.

Be on the lookout to take advantage of any market flutters.

We recently wrote about how potential earnings shifts could unfold as US corporate tax reduction is implemented next year.

By way of example, we assumed that this will be grandfathered to 1st January, 2017 though it will likely be summer before it is actually in place – that’s the norm each time a major tax reduction bill has unfolded.

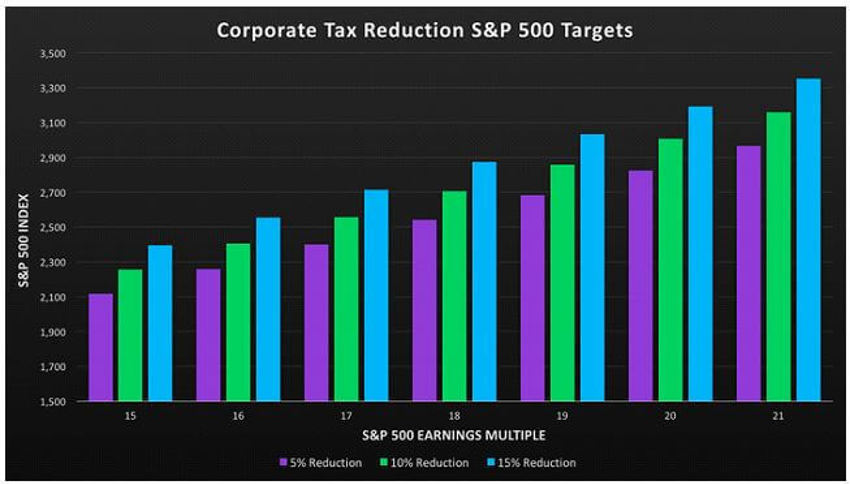

We also assumed three different tax reduction targets - 5%, 10% and 15% - and internally calculated the additional earnings that would fall to the current bottom line projection as a result, and used a range of market multiples (15 to 21) for S&P 500 valuation.

The two snapshots below show you, in both graphic and numerical form, where the targets would align under these circumstances.

Different View?

We can also use this data to provide another perspective.

For example, if the corporate tax rate only falls 10% and each percentage point represents about $1.84 falling to the bottom line, then earnings next year would rise to roughly $150.00 in the S&P 500.

If that were the case, then you have to wonder if the market truly feels "overvalued" at a 15 multiple (2265 / $150 in 2017 earnings, post tax reduction), especially in a world where bonds - even after a shellacking - are priced at just south of 40 times earnings.

This however does not account for any repatriation benefits we may see, or any increase in earnings power from regulation rollbacks.