The Breadcrumbs to Good Market News

Good Morning,

For those of you who like to study the structure of the market, I’ve prepped another short video review for you here as we edge closer to the mid-point of the summer haze.

Make sure you click and check the data - it only takes a few minutes and it should provide some calm as the rest of the haze unfolds.

Politically Speaking

Janet Yellen has been on Capitol Hill and Donald Trump seems stuck in the quicksand of the Washington DC political swamp.

Add that to the official kick-off of the larger flows from the Q2 earnings season on Friday and you have the makings of more chop and churn.

But don't fret - most of the good news is being overlooked as you will see below.

Upbeat Forward Guidance Continues

Earnings seasons are filled to the brim with constant adjustments by industry analysts who often earn their keep by revising their earnings estimates, usually based on the latest quarterly results reported by their companies.

They are also influenced by managements’ conference calls discussing those results as well as their forward guidance on their business prospects.

As noted above, we will see how the Q2-2017 season plays out over the next few weeks - but the breadcrumbs so far look pretty solid.

Dr Ed Yardeni reminds us that the analyst crowd is currently projecting growth rates of 10.3%, 7.0%, and 6.2% on a pro-forma basis for the three S&P indexes.

Even more impressive is the steadiness since last September of their S&P 500/600 estimates for 2018, while the estimate for the S&P 400 has been on a modest uptrend.

The analysts are predicting 2018 growth rates of 12.0%, 14.2%, and 19.3%.

And keep in mind how every season we tend to get a notch downward in expectations, and then a high beat rate.

My hunch is that we are beginning to see some expectation added that we will get some tax changes for 2018 - along with some refreshing reduction in regulatory costs.

If so, we should once again find the analysts will have been too conservative.

More Legs to the Stool

Keep in mind, the upward earnings moving us into new records is not just because of what may or may not unfold here in the US.

Given the strong market share worldwide, our corporate earnings numbers are seeing a boost from global improvement.

In fact, the global economy continues to show signs of slow but steady improvement.

This comfortably supports the fact that both S&P 500/400/600 forward earnings (which would be directly boosted by said tax cuts in 2018) and forward revenues (which wouldn’t be directly impacted) all are continuing to rise to new record highs.

Net-net, we can now wait and see as we wade through all the short-term, wildly poor, knee-jerk reactions as the season gets underway.

And when it does remain patient and disciplined; consensus expectations for this year and next year remain on solid, upward trends.

Globe Grows Collectively

Just this past week, the oldest technical indicator in the game - the Dow Theory - gave a new buy signal.

Imagine that.

In the midst of nearly endless gloom and doom, both the Transports and the Industrials hit new highs.

This in a market where more than 70% of AAII surveyed investors remain bearish or neutral on the market. This is supremely good news. But it demands we remain patient. It's summer after all; a perfect time to get stuck in mental quicksand.

Global PMI's - Positive

You may recall that last year European market participants feared everything from Brexit to the collapse of the Euro.

"Record lows in the Euro" headlines drove us to note, "Look for Germany to scoop up new orders on the cheap - while everyone runs to bonds again for nothing."

Sure enough, solid PMIs for the global economy during June, with the global composite remaining steady around 54.0 for the past six months, are positive signs; and likely drivers as to why we are hitting highs in shipping, exports, trucking, etc. etc. as those products move through the system to meet demand.

The Eurozone’s Manufacturing PMI rose to 57.4 in June, while the region’s NM-PMI dipped to a still-solid reading of 55.4. As expected last year, the trend is clear - Germany led the way on the M-PMI with a very strong 59.6, while the NM-PMI was led by Spain (58.3) and oddly - France (56.9).

Shoppers Shop

While too many fret over the end of brick and mortar here (getting too obvious), our retail sales remain on solid trends as noted below:

Overseas, support remains there too.

France is also leading the Eurozone in the volume of retail sales (excluding autos). The region’s sales are up 2.6% y/y through May, with solid gains in France (4.2%), Spain (2.9), Germany (2.3), and Italy (1.0).

New passenger car registrations also remain on solid uptrends in the major European economies.

The strongest economy in the Eurozone remains Germany, where industrial production rose 5.0% y/y during May to a fresh record high. The country is benefitting from booming exports (thank the cheap Euro and overblown fears of Brexit), which also pretty much confirms the global economy is doing well.

Back Home....New Hurdles

We need more people for openings in the jobs world. It’s a good problem to have. Demography rules as demand is causing business to need more jobs filled.

And we were worried about robots?

Bring on the robots, I say, and watch how the economy will expand further.

Labour Shortages Galore

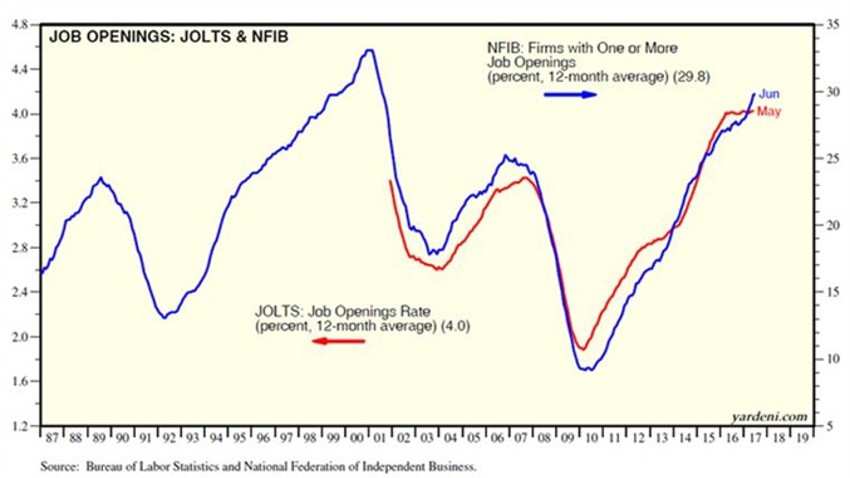

The latest survey of small business owners conducted by the National Federation of Independent Business (NFIB) found that 32.3% reported job openings that could not be filled on average over the past three months through June.

Ouch, that’s the highest reading since January 2001, but I’m confident someone headline writer out there will turn that into bad news!

This series of data starts in January 1986, and is highly correlated with the JOLTS data on the national job openings rate, which is available since December 2000 and is in record-high territory.

And the lack of wage pressure continues to baffle most folks. But it also drives home the (beneficial) deflationary forces brought on by Generation Y. This can be seen further in the national quits rate: It rose to a new cyclical high in May!

Take a look below from Dr Ed Yardeni…and remember; workers usually leave and take another job for better pay.

Note to self: check the blue line (the current data on job openings has been higher in only 18 previous months - since 1986!):

Up Next?

Earnings....more fear…more chatter…more Fed clutter…more DC crap…more wasted energy fretting over normal chop and churn.

It remains important that we not let ineffective emotions destroy wealth-building goals as they have for so many over the years.

Just remember that during this hazy part of the year, there is almost always a huge reach to make "something" out of what often becomes nothing over time.

Because of the thin crowd, low volumes (soon to shift even lower) and lack of interest if you will, the media process turns it up a notch to grab your attention.

Long-term investors will look beyond all this and steadily focus on the real driving forces of the economy.

Patience and discipline has taught us that every summer swoon before now has been a good deal. A positive, not a negative. Something to embrace, not something to fear.